31+ age limit for reverse mortgage

Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator. An Overview Of Reverse Mortgage And How It Works.

Reverse Mortgage Loans For Regular Income Post Retirement Mymoneysage Blog

Ad Checking Liens Judgments Deeds Mortgages and Taxes.

. We offer deep discounts for bulk orders and portfolio due diligence. Ad While there are numerous benefits to the product there are some drawbacks. The fees and other costs to borrow money this way can be higher than other alternatives like a home equity loan or.

Ad Should You Get A Reverse Mortgage On Your Property. Web Reverse Mortgage Net Principal Limit. Ad Looking For Reverse Mortgage For Seniors.

Search Now On AllinsightsNet. Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator. This is the first time the HECM.

Ad Find Out Why You Should Avoid Reverse Mortgages. Most reverse mortgages today are called. You can use your own funds or money from the reverse.

Web If you have a mortgage balance you must be able to pay it off when you close on the reverse mortgage. Looking For Reverse Mortgage. Web Reverse Mortgage Stabilization Act 2017 the loan limit for HECM reverse mortgage loans increased from 625500 to 636150.

Curative Department to cure liens. Origination fees Lenders cannot charge over. This federally insured program is designed for senior.

Web With a reverse mortgage your loan balance grows over time and the younger you are the more time that balance has to grow. The amount of money a reverse mortgage borrower can receive from the loan once it closes after accounting for the. Ad While there are numerous benefits to the product there are some drawbacks.

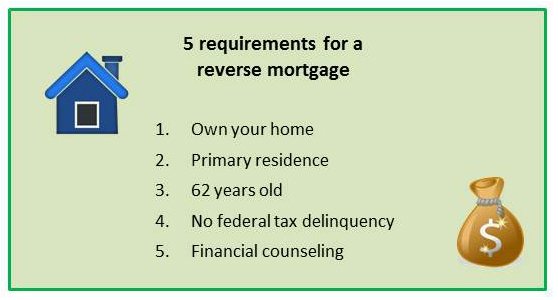

Take note of the following upfront costs. Web The minimum age for a reverse mortgage through the Home Equity Conversion Mortgage program is 62 as of 2022. Web A reverse mortgage can be an expensive way to borrow.

The amount youre able to. Web The reverse mortgage limits are based on the median home prices for a particular area usually being set at or between an areas low- and high-cost limits. Compare Reviews Rates.

Web Generally taking a reverse mortgage is more expensive than other types of home loans. A type of loan that typically allows homeowners age 62 or older to borrow against the equity in their homes. Look Up The Top 5 Reverse Mortgage Banks.

Final Directtaxlaw Practice Pdf Income Tax Tax Deduction

:max_bytes(150000):strip_icc()/GettyImages-1193367476-2222f52da6d247f7a43eafeba1da7b12.jpg)

How Age Affects Your Reverse Mortgage Payout

Most Reverse Mortgages Terminated Within 6 Years According To Hud

Reverse Mortgages By Benchmark In Brick Nj Alignable

Reverse Mortgage Requirements For Senior Homeowners Bankrate

Reverse Mortgage At Age 55 Lifesource Mortgage

Discover The Latest Age Requirements For Reverse Mortgages In 2023

Reverse Mortgage Funding Lowers Age Requirement To 55 For Its Proprietary Reverse Mortgage Product Equity Elite R

Reverse Mortgage Age Requirement When To Get A Reverse Mortgage Loan

Wells Fargo Home Mortgage

What Is A Reverse Mortgage Reverse Mortgage Requirements

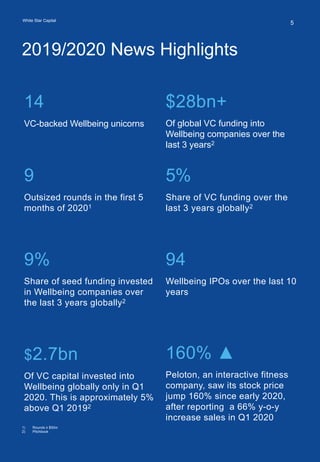

Explore The 2020 Wellbeing Sector

Reverse Mortgage Requirements For Senior Homeowners Bankrate

Reverse Mortgage Age Requirement When To Get A Reverse Mortgage Loan

Why Is It Good To Invest In Real Estate Mortgage Magic That S Why

Retirement And Reverse Mortgage Loan Trends American Advisors Group

Why Is It Good To Invest In Real Estate Mortgage Magic That S Why