Day trading tax calculator

Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. Get up to 12 free stocks for a limited time when you open and fund a new account.

What Is Annual Income How To Calculate Your Salary

ITR Form ITR-3 For individuals and HUFs having income from profits and gains of business or profession Due.

. The default values already entered are for an E-mini SP500 ES trader making 125 points per trade etc Ask. Time and Date Duration Calculate duration with both date and time included. So in this case unearned doesnt mean you dont deserve that money.

Income seems like a straightforward concept but little about taxation is straightforward. Do Your Investments Align with Your Goals. Ad Were all about helping you get more from your money.

Enter the values that match what you trade to find your target millionaire date. To the IRS the money you make as a day trader falls into. 10000 then they must calculate and pay Advance Tax.

As a result you cant use the 50 capital gains rate on any. 025 paise or INR 00025. 12 month trading cycle.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. The gain realized from selling a long-term holding is taxed at a lower rate than short-term gains. Similar to investing the tax also accounts for the losses.

30 Day Free Trial. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. Ad Spend Your Time Trading Not Wondering What it Costs.

If you fall under this bracket any day trading profits are free from income tax business tax and capital gains tax. The long-term capital gains rate and the short-term capital gains rate. We provide turnkey service solutions with Trader Tax Solutions by TradeLog letting you focus your time on trading while we take care of the tax part.

900 am to 500 pm Monday to Friday on working days Contract trading cycle. Even if youre actively day trading on your laptop the income you make from your investments is considered passive. If a stock is held for less than.

If the tax liability of the trader or investor is expected to exceed Rs. To begin your calculation take your daily interest rate and add 1 to it. Many new investors view day trading as an efficient way to earn money quickly.

Lets get started today. The idea behind the concept is to make trades over short periods to take advantage of short-term. Ad Our Resources Can Help You Decide Between Taxable Vs.

Next raise that figure to the power of the number of days it will be compounded for. In the case of individuals HUFs engaged in intraday trading the applicable tax rate will be ranging from 5 to 30 plus surcharge cess depending upon the income slab. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

FO Intraday Trading Non-Speculative Business Income. Date Calculator Add or. This sale results in a long-term gain as the holding period was more than 365 days.

Find a Dedicated Financial Advisor Now. The first category is speculative in nature and similar to gambling activities. The day trading tax rate is 10 for taxable income up to 9325 15 for 9326 to 37950 25 for 37951 to 91 900 and 28 for 91901 to 191680.

For day traders any profits and losses are treated as business income not capital. For day trading you simply pay tax on your income after any expenses. Business Income and Losses.

Duration Between Two Dates Calculates number of days. Day Trading For Dummies. There are two capital gains rates in the US that can affect taxes on day trading.

Dear Tax Talk I am a day trader who is trading in the foreign exchange currency market. A capital loss can be deducted from the rest of. Ad Spend Your Time Trading Not Wondering What it Costs.

Whatever Your Investing Goals Are We Have the Tools to Get You Started. Retirement plan income calculator. Calculate Advance Tax on Trading Income.

Ad Real-time quotes and premium tools to help you with enhancing your trading experience.

Effective Tax Rate Formula Calculator Excel Template

Capital Gains Tax Calculator The Turbotax Blog

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Retirement Savings Spreadsheet Spreadsheet Stock Trading Strategies Saving For Retirement

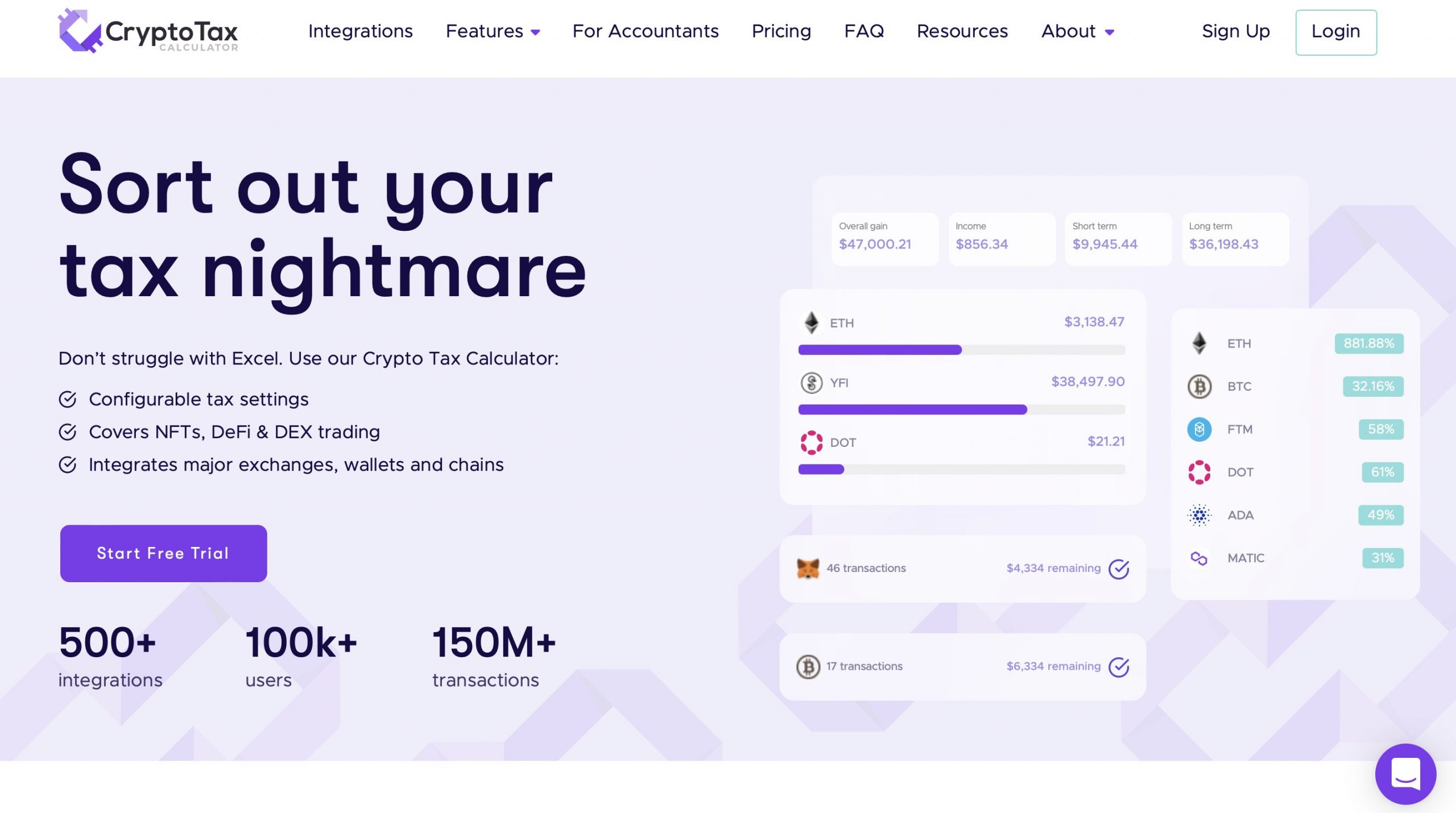

11 Best Crypto Tax Calculators To Check Out

Uk Hmrc Capital Gains Tax Calculator Timetotrade

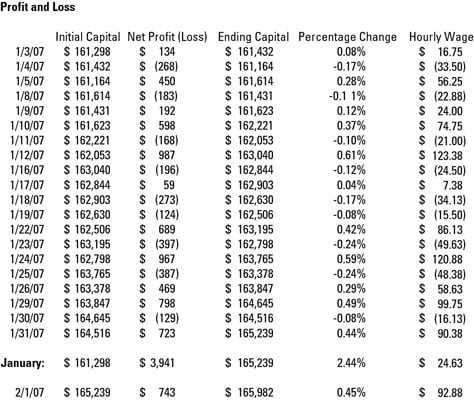

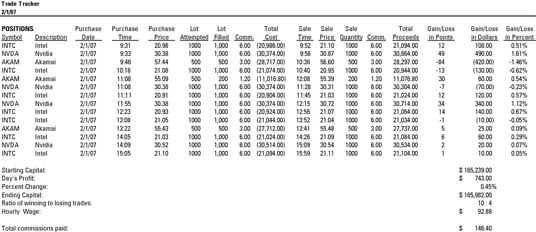

How To Keep Track Of Your Day Trading Gains And Losses Dummies

How To Sell Your Own House 15 Steps With Pictures Mortgage Payment Calculator Financial Mortgage Payment

Black Calculator On A Mathematics Book Free Image By Rawpixel Com Math Tutorials Scientific Calculator Learning Math

Tax Percentage Calculator In 2022 Online Taxes Tax Saving Investment Online Income

Effective Tax Rate Formula And Calculation Example

Day Trading Taxes How Profits On Trading Are Taxed

How Traders Should Manage Their Taxes In This Day And Age Tax Attorney Tax Help Attorneys

How To Keep Track Of Your Day Trading Gains And Losses Dummies

Effective Tax Rate Formula Calculator Excel Template

11 Best Crypto Tax Calculators To Check Out

Daily Trading Affirmation Mitul Mehta Affirmations Daily Affirmations Trading Quotes